CRE Lending Update: Bumps, Adjustments, and a Glimpse of Sunshine

Overall, the outlook for CRE is cautiously optimistic. The market is adjusting to the new normal, and there are signs of a potential rebound later this year.

Overall, the outlook for CRE is cautiously optimistic. The market is adjusting to the new normal, and there are signs of a potential rebound later this year.

This past week, thousands of real estate professionals descended upon San Diego to attend the NMHC Apartment Strategies Conference. There, a distinguished lineup of multifamily experts provided insight.

Thank you for being a part of our family. We wish you a Thanksgiving filled with love, laughter, and happiness.

The CRE landscape has transformed significantly in 2023, with key trends and insights shaping the current landscape and informing expectations for the last quarter of the year.

When it comes to financing multifamily and commercial real estate, the assumption that a bank is the sole option for borrowers is far from the truth. In today’s dynamic market, while banks and credit unions play a role, there exists a multitude of alternative financing options.

Allocating capital is a complex process, involving individual investor criteria and the consideration of the most suitable risk-return profile. The capital stack can help simplify this decision-making process.

How do you negotiate financing options for commercial real estate?

Cap rate, short for capitalization rate, is a crucial metric in the world of real estate investment. It serves as a benchmark for comparing property values and offers a quick estimate of your expected return on investment (ROI). In essence, cap rates can be distilled into a simple formula:

Cap Rate = Net Operating Income (NOI) / Current Market Value

Generative AI – known by various brand names including ChatGPT, Bard, DALL-E and DeepMind – could help transform the commercial real estate sector.

1031 is a great way to preserve equity, reposition assets and defer substantial amounts in taxes. 1031 Exchanges can be a great estate planning tool for real estate investors.

Wishing everyone a bright and healthy New Year from INSIGNIA Financial Services LLC! https://insigniafs.com/wp-content/uploads/2022/12/IFS-2023-Happy-New-Year-Facebook-Post-1-1.mp4

Freddie Mac will begin accepting ownership of two- to four-unit properties (duplexes, triplexes or quadplexes) as relevant experience for all loans in its Optigo® Small Balance Loans (SBL) program.

Investing in real estate is a very lucrative business, but you can only succeed with access to capital.

Private and hard money loans are great options for real estate investors because they give you access to capital with fewer requirements and greater certainty.

Join Root Realty and INSIGNIA Financial Services LLC for the Southside Landlord Enrichment Event

Long term rental loans, or DSCR (debt service coverage ratio) loans, have become popular in recent years for investors looking to buy and hold properties. Borrowers love them because these loan types allow them to qualify for a financing using their property’s cash flow rather than their income, and lenders love them because they can be highly accretive to their loan portfolios held for investment.

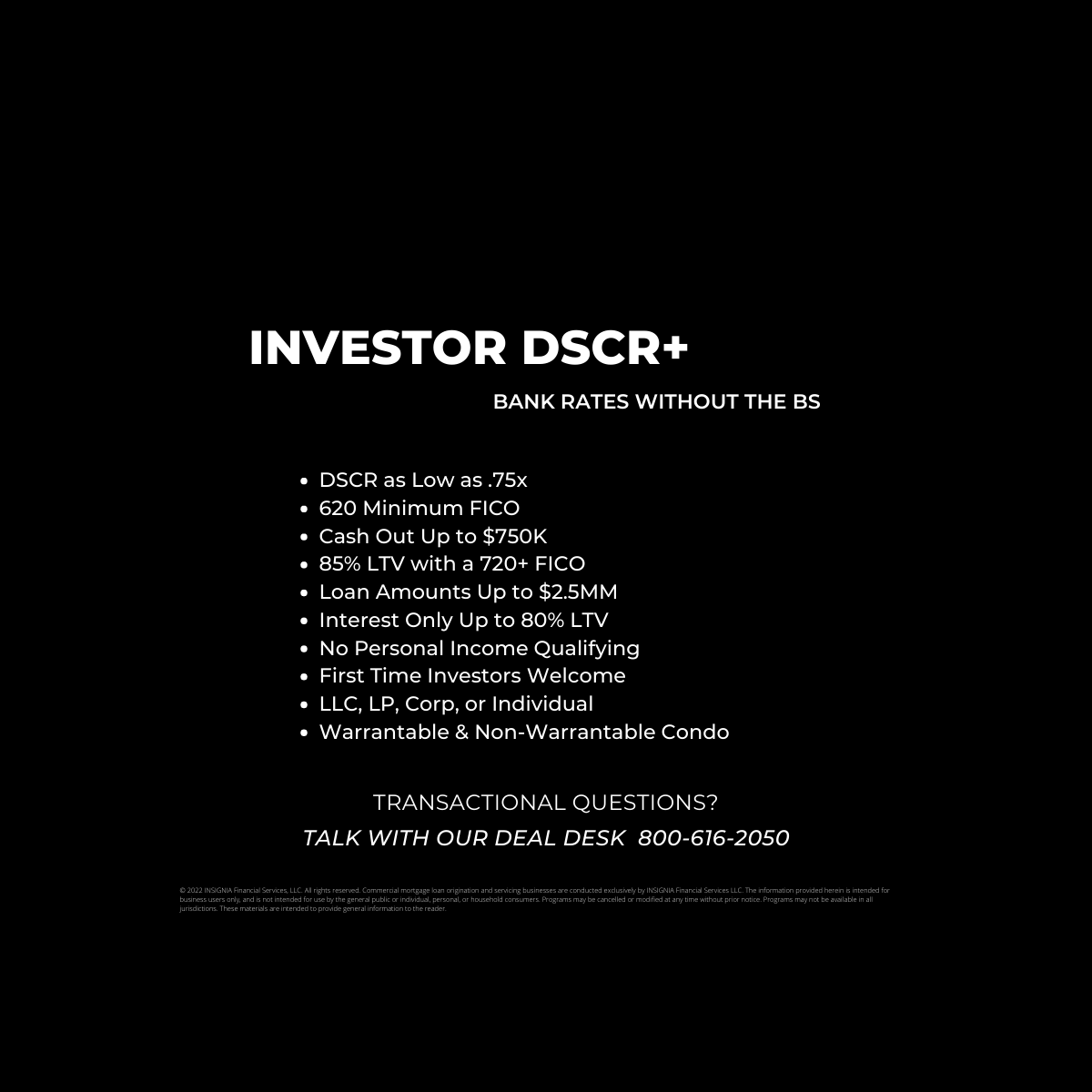

INSIGNIA Investor DSCR+ Loan

DSCR as Low as .75x

620 Minimum FICO

Cash Out Up to $750K

85% LTV with a 720+ FICO

Loan Amounts Up to $2.5MM

Interest Only Up to 80% LTV

No Personal Income Qualifying

First Time Investors Welcome

LLC, LP, Corp, or Individual

Warrantable & Non-Warrantable Condo

Good cause eviction legislation has been gaining momentum in recent months, especially in New York state. Since last summer, four upstate cities have passed good cause eviction laws, including Albany, Poughkeepsie and Newburgh. Meanwhile, smaller towns like New Paltz, Kingston, and Hudson are also considering passing similar bills.

Could agency lending be the right fit for your multifamily investment? While there are many options to consider when financing your multifamily property, INSIGNIA is here to help you navigate the process. For more information, talk to one of our multifamily experts or get an instant quote through our instant quote tool.

Yet, most investors don’t know how to take advantage of these tax benefits. A real estate investor focused, virtual CFO will

The vast majority of apartment properties are performing well despite the crisis caused by the coronavirus; however, that may change if lawmakers do not renew or replace the programs supporting millions who lost jobs or income, according to mid-2020 forecasts from economists at three apartment market research firms.

INFORMATION AND RESOURCES FOR SMALL BUSINESS DURING COVID-19 As our global community looks to contain and combat COVID-19 (or what’s

INSIGNIA loves working with investors in single family rental (SFR) properties (single family, townhouse, condo, 2-4 unit) due to their defensive nature and durable moat. Given the late stage of the market cycle, we are seeing a focus on affordable housing since investors largely believe this sector will outperform higher class housing in a recession. Multifamily investing is an excellent strategy, but requires a little more sophistication and capital when done properly.

Competition among investors for single-tenant net-lease properties intensified last year, sending cap rates down to historic lows, and the widespread eagerness to buy in this market may not slow down in 2020, according to a Q4 net-lease report by Wilmette, Illinois-based The Boulder Group.

Industrial properties have been highly sought-after by investors for the past several years. Will that trend continue in 2020?

Correlation to higher percentage of long-term renters for real estate investors in single family and multifamily rentals.

Fewer than 10% of Americans moved to new places in the 2018-2019 year, the lowest rate since the Census Bureau began tracking domestic relocations in 1947.

Why it matters: Despite a strong economy, more people are feeling locked in place. Young adults, who have historically been the most mobile, are staying put these days thanks to housing and job limitations. So are aging adults who are reluctant to (or can’t afford to) make a move.

The multifamily sector continues to draw a steady demand for financing.

The information provided herein is intended for business users only and is not intended for use by the general public or individual, personal, or household consumers. Programs may be cancelled or modified at any time without prior notice. Programs may not be available in all jurisdictions. These materials are intended to provide general information to the reader. This information is made available with the understanding that INSIGNIA Financial Services, LLC is not engaged in rendering legal, accounting, or other professional services. We use reasonable care in providing information but cannot guarantee accuracy or completeness. Information is provided with no warranty, express or implied, any and all such warranties are expressly disclaimed. We assume no liability for any loss, damage, or expense from errors or omissions in these materials, whether arising in contract, tort, or otherwise. Freddie Mac® and Optigo® are registered trademarks of Freddie Mac. Fannie Mae® is a registered trademark of Fannie Mae. INSIGNIA Financial Services LLC is not affiliated with the Department of Housing and Urban Development (HUD), Federal Housing Administration (FHA), Freddie Mac or Fannie Mae.