Coronavirus Aid, Relief, And Economic Security Act

On March 27, 2020, the President of the United States of America enacted the Coronavirus Aid, Relief, and Economic Security Act (the “CARES Act”), that increases the maximum Small Business Administration’s 7(a) loan amount to $10 million and would expand allowable uses of 7(a) loans to include payroll support (including paid sick or medical leave), employee salaries, mortgage payments, insurance premiums and any other debt obligations.

SBA 7(a) Relief Loans under the Cares Act vs. 7(b) SBA economic injury disaster loan (EIDL) loan program. It is important to note that this portion of the CARES Act is not the same as the 7(b) SBA economic injury disaster loan (EIDL) loan program that is already available on the SBA website, nor may it be used for the same purpose. Interested borrowers should evaluate both programs and choose accordingly.

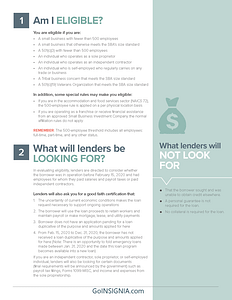

Eligibility evaluations for 7(a) Relief loans are to be limited to whether a business or certain non-profits was:

- Operational on February 15, 2020, and

- had employees for whom the borrower paid salaries and payroll taxes, or paid independent contractors, and

- is substantially impacted by public health restrictions related to COVID-19. (Eligible borrowers would be required to make good faith certification that they have been affected by COVID-19 and will use funds to retain workers and maintain payroll and other debt obligations.) There is no requirement to evaluate the borrowers’ ability to repay the covered loan or that the borrower not be able to find credit elsewhere, unlike the normal 7(a) requirements.

SBA EIDL Loan vs. SBA 7(a) Relief Loan

SBA 7(a) Relief Loans (as of 3/27/2020)

- Apply through INSIGNIA now (click here)

- Loan amount up to $10,000,000

- Interest rate set at 4%

-

10-year full payout loan, and payments may be deferred for one year

-

Unsecured and no personal guarantee

-

Eligible for loan forgiveness

- Loan proceeds are only for payroll support including medical leave, costs related to health benefits, employee salaries, mortgage payments, rent, utilities, insurance, and any other debt payments incurred before 2/15/2020

- Relief loans are not eligible for business acquisition, real estate purchase, or other typical 7(a) proceeds, but may be eligible for business debt refi’s – stay tuned

- Borrower SBA Guarantee Fee will be waived

- No prepayment penalties

- We’re anticipating an approval within a few days after submission, provided all required documentation is received from Borrower.

- A Borrower with a current EIDL loan can only also receive the SBA 7(a) Relief loan if the EIDL loan is unrelated to COVID-19.

While we realize time is of the essence and funding is essential at this point, it is our belief that the SBA 7(a) Relief Loan will be the better option for the following reasons:

- There is already a bottleneck of well over 25,000 applications with the SBA for EIDLs with approvals expected to be at least 3 weeks with funding even further out.

- EIDL Funds are limited to $2 million.

- With the SBA 7(a) Relief Loans, it is anticipated that the entire process will be streamlined for quicker approvals and funding. We are mobilizing to provide approvals in minutes and funding within weeks.

Economic Injury Disaster Loan (EIDL)

- Apply through the SBA (click here)

- Loan amount up to $2,000,000

- 3.75% interest rate for For-Profit companies

- 2.75% interest rate for Not-For-Profit companies

- Loan term not to exceed 30 years

- Only available in states with SBA approved declarations of disaster (As of 3/20/2020 – Alabama, Arizona, California, Colorado, Connecticut, Delaware, District of Columbia, Florida, Georgia, Idaho, Illinois, Indiana, Iowa, Louisiana, Maine, Maryland, Massachusetts, Michigan, Minnesota, Mississippi, Missouri, Montana, Nebraska, New Hampshire, New Jersey, New Mexico, New York, Nevada, North Carolina, North Dakota, Ohio, Oklahoma, Oregon, Pennsylvania, Rhode Island, South Carolina, South Dakota, Tennessee, Virginia, West Virginia, Washington, Wisconsin, Wyoming, and Utah) This is the most current data we could find and continues to evolve.

- We understand there are currently over 25,000 applications submitted with at least 3-week approval times. As the number of applications grow, it is anticipated the approval times will be pushed out longer with funding coming several weeks after that.

- If you receive the EIDL, you will not be eligible for the SBA 7(a) Relief Loan