Commercial Real Estate Market Update Q4 2023

The CRE landscape has transformed significantly in 2023, with key trends and insights shaping the current landscape and informing expectations for the last quarter of the year.

The CRE landscape has transformed significantly in 2023, with key trends and insights shaping the current landscape and informing expectations for the last quarter of the year.

When it comes to financing multifamily and commercial real estate, the assumption that a bank is the sole option for borrowers is far from the truth. In today’s dynamic market, while banks and credit unions play a role, there exists a multitude of alternative financing options.

How do you negotiate financing options for commercial real estate?

Acquiring and rehabbing properties can be the key to successful real estate investments. It not only increases resale value and profit but also allows investors to enter new markets and diversify their portfolios.

1031 is a great way to preserve equity, reposition assets and defer substantial amounts in taxes. 1031 Exchanges can be a great estate planning tool for real estate investors.

Wishing everyone a bright and healthy New Year from INSIGNIA Financial Services LLC! https://insigniafs.com/wp-content/uploads/2022/12/IFS-2023-Happy-New-Year-Facebook-Post-1-1.mp4

Investing in real estate is a very lucrative business, but you can only succeed with access to capital.

Private and hard money loans are great options for real estate investors because they give you access to capital with fewer requirements and greater certainty.

Low supply and strong demand will limit the extent home prices depreciate. If our forecast for Fed rate cuts is realized, mortgage rates are likely to fall slightly, which will spur an improvement in sales activity and reignite home price appreciation heading into 2024.

Now is an ideal time to review your commercial real estate financing that may be maturing within the next two to four years and determine whether it would be beneficial to refinance in advance of the scheduled Maturity Date. Consider key factors, such as the ability to lock in a new rate and access equity or reduce risk with an extended term, while also weighing pre-payment terms to determine how much may be saved over the term of a new loan.

INSIGNIA Financial Services provides access to comprehensive debt placement and equity syndication for all your commercial real estate financing needs, including conventional agency financing, permanent financing, bridge loans, rate and term refinances, cash-out refinances, investment equity lines and loans, as well as acquisition and rehab loans

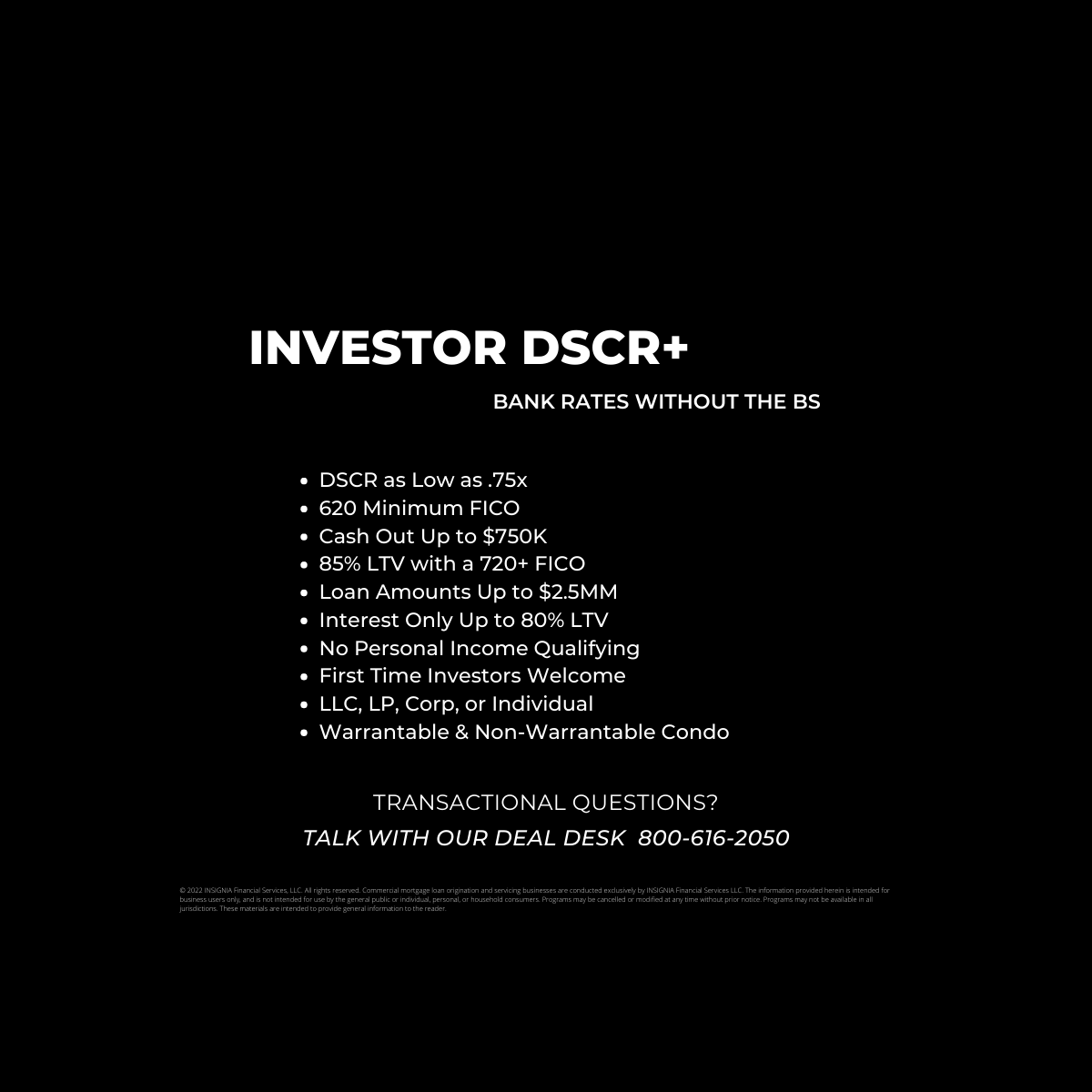

INSIGNIA Investor DSCR+ Loan

DSCR as Low as .75x

620 Minimum FICO

Cash Out Up to $750K

85% LTV with a 720+ FICO

Loan Amounts Up to $2.5MM

Interest Only Up to 80% LTV

No Personal Income Qualifying

First Time Investors Welcome

LLC, LP, Corp, or Individual

Warrantable & Non-Warrantable Condo

Yet, most investors don’t know how to take advantage of these tax benefits. A real estate investor focused, virtual CFO will

The vast majority of apartment properties are performing well despite the crisis caused by the coronavirus; however, that may change if lawmakers do not renew or replace the programs supporting millions who lost jobs or income, according to mid-2020 forecasts from economists at three apartment market research firms.

Industrial properties have been highly sought-after by investors for the past several years. Will that trend continue in 2020?

With strong rental growth and lower interest rates, the time looks favorable for acquiring more single-family rentals.

The information provided herein is intended for business users only and is not intended for use by the general public or individual, personal, or household consumers. Programs may be cancelled or modified at any time without prior notice. Programs may not be available in all jurisdictions. These materials are intended to provide general information to the reader. This information is made available with the understanding that INSIGNIA Financial Services, LLC is not engaged in rendering legal, accounting, or other professional services. We use reasonable care in providing information but cannot guarantee accuracy or completeness. Information is provided with no warranty, express or implied, any and all such warranties are expressly disclaimed. We assume no liability for any loss, damage, or expense from errors or omissions in these materials, whether arising in contract, tort, or otherwise. Freddie Mac® and Optigo® are registered trademarks of Freddie Mac. Fannie Mae® is a registered trademark of Fannie Mae. INSIGNIA Financial Services LLC is not affiliated with the Department of Housing and Urban Development (HUD), Federal Housing Administration (FHA), Freddie Mac or Fannie Mae.